Maryland auto insurance quotes: Finding the best rates is crucial for drivers in the state. This guide will walk you through the process, highlighting key factors to consider and providing tips to save money.

Understanding the different types of coverage available in Maryland and how they apply to your specific needs is essential. This includes liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Comparing quotes from various insurers will help you find the best policy that fits your budget and driving habits.

Finding the right auto insurance in Maryland can feel like navigating a maze. But it doesn’t have to be daunting. This comprehensive guide will walk you through the process of getting Maryland auto insurance quotes, explaining the factors that influence rates, and helping you find the best policy for your needs.

Source: cheapcarinsurancequotes.com

Understanding Maryland Auto Insurance Requirements

Maryland law mandates minimum liability insurance coverage. However, this minimum often isn’t enough to protect you and your assets. Understanding the different types of coverage—liability, collision, comprehensive, and uninsured/underinsured—is crucial. Liability coverage protects you if you’re at fault in an accident, while collision and comprehensive cover damage to your vehicle regardless of fault. Uninsured/underinsured coverage kicks in if the at-fault driver doesn’t have enough insurance to cover your damages.

Factors Affecting Your Insurance Rates, Maryland auto insurance quotes

Several factors significantly impact your auto insurance premiums in Maryland. These include:

- Driving Record: Accidents, speeding tickets, and DUIs will significantly increase your rates. A clean driving record is a major factor in securing a competitive quote.

- Vehicle Type and Value: Luxury cars and high-performance vehicles typically have higher premiums due to their perceived risk. The value of your vehicle also affects rates, as higher values generally mean higher coverage amounts and potential for higher claims.

- Location: Certain areas of Maryland have higher rates due to higher accident frequency or other risk factors. Your specific address will impact your quote.

- Age and Gender: Younger drivers and male drivers, on average, tend to have higher premiums due to statistically higher accident rates in these demographics.

- Claims History: Past claims, even for minor incidents, can impact your future rates.

- Insurance History: If you’ve had a lapse in insurance coverage, your rates will likely be higher.

- Discounts: Maryland insurers offer various discounts, including those for good student drivers, safe driving programs, and anti-theft devices. Look for any discounts you might qualify for.

Getting Maryland Auto Insurance Quotes

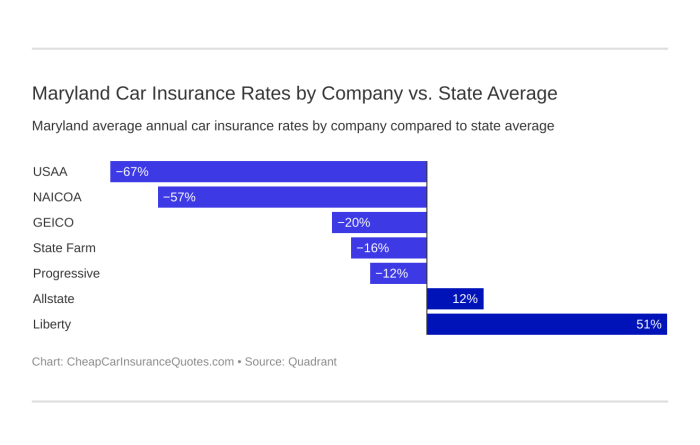

Obtaining multiple quotes is key to finding the best possible rate. Compare quotes from different insurers to see how they vary. Factors like the type of coverage, deductibles, and discounts will affect the final price.

Tips for Getting Competitive Quotes

- Use Online Comparison Tools: Numerous websites allow you to compare quotes from various insurers in Maryland, saving you time and effort.

- Contact Insurers Directly: Don’t hesitate to call insurers directly to ask questions and get personalized quotes.

- Review Your Current Policy: Assess your current coverage and identify areas where you can potentially save money.

- Consider Bundling: Bundling your auto insurance with your home or other insurance policies might lead to discounts.

Choosing the Right Coverage for You: Maryland Auto Insurance Quotes

Maryland’s minimum coverage requirements are not always sufficient. Consider your financial situation and potential risks to choose appropriate coverage levels. Don’t hesitate to consult with an insurance agent to determine the ideal coverage for your specific needs.

Source: clovered.com

Frequently Asked Questions (FAQ)

- Q: What is the minimum liability insurance required in Maryland?

A: Maryland requires a minimum of $30,000 bodily injury liability per person, $60,000 per accident, and $25,000 property damage liability.

- Q: How often should I review my auto insurance policy?

A: Reviewing your policy annually or whenever significant life changes occur (e.g., marriage, new driver in the household, change of address) is recommended.

- Q: Can I get a discount for having multiple vehicles insured?

A: Yes, many insurers offer discounts for multiple vehicles insured under the same policy.

- Q: What is the best way to save money on car insurance?

A: Comparing quotes from multiple insurers, maintaining a clean driving record, and exploring available discounts are key ways to save.

Note: Information presented here is for general knowledge and informational purposes only, and does not constitute financial or legal advice. Consult with a qualified professional for personalized guidance.

Sources

Call to Action

Ready to get started with finding the best auto insurance quote for your Maryland needs? Visit our website today to compare quotes from multiple insurers and find the perfect policy for you. Don’t wait; secure your peace of mind and protect your assets today!

In conclusion, securing the right Maryland auto insurance quotes requires careful consideration of your needs and budget. By comparing quotes and understanding the available coverage options, you can confidently choose a policy that protects you and your vehicle. Remember to review your policy regularly and adjust it as your needs change.

FAQ Corner

What factors influence auto insurance premiums in Maryland?

Several factors impact your auto insurance premiums in Maryland, including your driving record (including accidents and traffic violations), your vehicle type and model, your location, and your age and gender. Insurance companies use this data to assess risk and determine your premium.

Are there any discounts available for Maryland auto insurance?

Yes, many insurers offer discounts for safe driving, good student status, defensive driving courses, and certain anti-theft devices. Investigating these discounts can significantly lower your premium.

How can I compare Maryland auto insurance quotes effectively?

Use online comparison tools or contact multiple insurance providers directly to get quotes. Comparing quotes side-by-side will help you identify the best value for your needs. Don’t forget to consider the reputation and financial stability of the insurer.